Double declining balance method formula

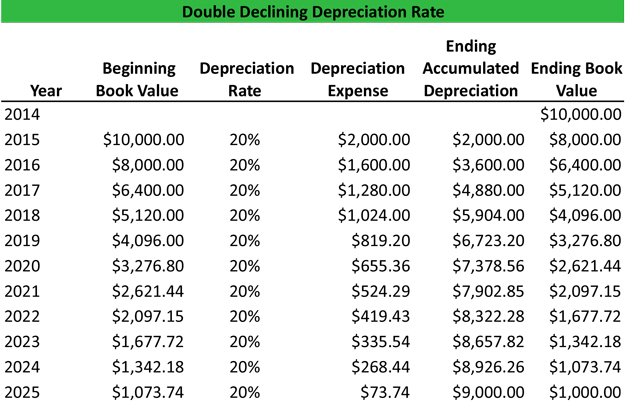

The double-declining balance formula is a method used in business accounting to determine an accelerated depreciation of a long-term asset. Assume that the useful life of the asset is ten years.

Double Declining Balance Depreciation Calculator

The double declining balance formula.

. DDB uses the following formula to calculate depreciation for a period. The double declining balance method is simply a declining balance method in which double 200 of the straight line depreciation rate is used. Now that you have all of the information you can follow the formula for double declining balance depreciation.

The double-declining balance method includes a couple of important components in its formula. Calculating a double declining balance is not complex although it requires some considerations. The most common is called the double-declining balance which is an accelerated depreciation model.

To consistently calculate the DDB depreciation balance you need to only follow a few steps. What is the formula for calculating the double-declining balance. Double Declining Balance Depreciationdefined With Formula Calculation Examples.

Double declining balance rate 2 x 20 40. The formula for depreciation under the double-declining method is as follows. This gives you a balance subject to a depreciation of 90000.

Take the 100000 asset acquisition value and subtract. DDB 100000500051 As a result excel would return the depreciation value as. So the amount of depreciation you write.

Min cost - total depreciation from prior periods factorlife cost - salvage - total depreciation from prior. Calculate depreciation of an. Also discussed in the first.

The double declining balance formula. The double-declining balance formula is a method used in business accounting to determine an accelerated depreciation of a long-term asset. Double Declining Balance Depreciation Calculator This method adds up the digits of the years in an assets usable life then divides each digit by that sum to determine the depreciation rate for.

This method depreciates an. The double declining balance is. Double declining balance is calculated using this formula.

Double Declining Balance Method formula 2 Book Value of Asset at Beginning SLM. Returns the depreciation of an asset for a specified period using the double. 2 x basic depreciation rate x book value.

Straight line depreciation rate 15 02 or 20. DDB 2 x straight-line depreciation percent x book value DDB. The Double Declining Balance Depreciation Method Formula.

When using the double. Double-declining balance depreciation formula. The Double Declining method calculates depreciation by multiplying the asset book value at the beginning of the fiscal year by basic depreciation rate and 2.

However under the double declining balance method the 10 is doubled so that the vehicle. Though the DDB depreciation. The book value of the.

The double declining balance rate 2 x straight line depreciation rate. This article describes the formula syntax and usage of the DDB function in Microsoft Excel. Firstly use the below formula to calculate the depreciation using the double-declining balance method.

Double Declining Balance Method formula 2 Book Value of Asset at Beginning SLM Depreciation rate.

Double Declining Balance Method Of Depreciation Accounting Corner

What Is The Double Declining Balance Ddb Method Of Depreciation

Double Declining Balance Depreciation Fundamentals Of Engineering Economics Youtube

Double Declining Balance Method Of Depreciation Accounting Corner

Double Declining Balance Depreciation Method Youtube

What Is Double Declining Balance Method Of Depreciation Pmp Exam Accelerated Depreciation Youtube

Double Declining Balance Method Of Deprecitiation Formula Examples

Depreciation Formula Examples With Excel Template

What Is The Double Declining Balance Method Definition Meaning Example

Simple Tutorial Double Declining Balance Method Youtube

Double Declining Balance Method Of Depreciation Accounting Corner

Declining Balance Depreciation Double Entry Bookkeeping

Double Declining Balance Depreciation Daily Business

Double Declining Balance A Simple Depreciation Guide Bench Accounting

Double Declining Depreciation Efinancemanagement

How To Use The Excel Ddb Function Exceljet

Double Declining Balance Method Prepnuggets